Are you ready to enter the world of hassle-free tax filing? ATC Income Tax’s user-friendly “Tax Calculator” is here to help you easily breeze through tax season. But did you know that filing your tax returns on time is more than a legal obligation? It opens the door to many financial benefits, ensuring you don’t miss out on valuable credits and deductions. Additionally, you will learn about the advance tax refunds you may be entitled to using the calculator.

The tax code in the United States is designed to encourage compliance by offering various incentives to those who file their taxes diligently. With ATC Income Tax’s intuitive “Tax Calculator,” you can streamline the filing process and optimize your potential for receiving the credits you deserve.

Whether you’re a seasoned taxpayer or a first-timer, this guide is here to demystify the process and help you understand the complexities of calculating three key credits: Earned Income Credit (EIC), Child Tax Credit (CTC), and Education Credit (EC).

So, let’s get started and help you gain the knowledge and tools to make tax season a breeze. We’ll ensure that you maximize your financial benefits while fulfilling your duty. Are you ready to take control of your tax journey?

How to Use Earned Income Credit (EIC) Calculator

Earned Income Credit (EIC) is a powerful tool to support hardworking families with low to moderate incomes. As the most popular advance tax refund credit, EIC can significantly boost your refund, and ATC Income Tax’s user-friendly “Tax Calculator” is here to simplify the process. Let’s explore the step-by-step guide to efficiently calculate Earned Income Credit using ATC’s intuitive tool:

Step 1: Accessing the EIC Calculator

To maximize your advance tax refund, visit ATC Income Tax’s website and locate the user-friendly EIC Calculator. This tool is designed to guide you through a series of questions, ensuring it captures all relevant information to give you accurate calculations.

Step 2: Providing Basic Information

The series of questions you need to answer to calculate EIC is given below:

Question 1: Did you – or your spouse if filing jointly – have earned income in the tax year 2022?

- Answers:

- Yes

- No

Question 2: Do you – your spouse, if married, filing jointly – and all Qualifying Children have a valid Social Security number?

- Answers:

- Yes

- No

Question 3: What is your Filing Status?

- Answers:

- Single

- Head of Household

- Married Filing Joint

- Married Filing Separate

- Qualifying Widower

Question 4: Do you have any Qualifying Children?

- Answers:

- None

- 1

- 2

- 3 or more

Step 3: Income Verification

After the four questions, you’ll be asked to share your Adjusted Gross Income (AGI) in 2022, based on which your EIC will be calculated. Enter the amount as prompted, and the calculator will notify you whether you qualify for the credit.

Step 4: Additional Qualification Criteria

Before you proceed with filing your taxes, it’s important to make sure you meet the following criteria:

- You should not have income from foreign sources that require you to file Foreign Income Form 2555 or 2555-EZ.

- Your investment income should not be greater than or equal to $3400.

- You should not be considered a Qualifying Child for EIC on someone else’s tax return.

- You must be a Citizen or a Resident Alien for the ENTIRE year. However, there is an exception for non-resident aliens married to a U.S. Citizen or Resident Alien and are filing a joint return. In such cases, you may file a joint return even if you are a non-resident alien.

Step 5: Get Your Answer

After providing all necessary information, review your responses to ensure accuracy. The ATC Income Tax’s EIC Calculator will then generate your potential Earned Income Credit, clarifying whether you qualify for an advance tax refund.

How to Use Child Tax Credit Calculator or CTCulator

If you are a parent or guardian looking for financial support to care for your family, you might be eligible for the Child Tax Credit (CTC). And guess what? ATC Income Tax has a fantastic tool called the “CTCulator” that simplifies determining your eligibility and potential credit amount or advance tax refund. How to use CTCulator? We’ll take you through the simple steps of using it to calculate your Child Tax Credit quickly and efficiently.

Step 1: Understanding Child Tax Credit Basics

The Child Tax Credit is a valuable tax benefit available to parents who have qualifying children. It offers a non-refundable tax credit of up to $2,000 per child on their federal tax return. This means that the credit can only be used to offset any tax liability a parent owes.

However, if a parent’s tax liability is lower than the credit, they may be eligible for the fully refundable Additional Child Tax Credit, which can provide up to $1,500 per child.

Furthermore, since 2018, parents may also qualify for a personal tax credit of up to $500 for other qualified dependents in their household. This credit can be claimed for any dependents not qualifying children, such as elderly parents or adult children with disabilities.

Overall, the Child Tax Credit and Additional Child Tax Credit can provide financial support to families with children, and the personal tax credit for dependents can offer additional relief for those caring for non-child dependents.

Step 2: Learn How to Maximize Child Tax Credit Benefits

- You can use a tax credit of up to $2,000 for each eligible child. To maximize your benefit, apply for the credit for all qualified children. This can help you get the full tax credit you’re entitled to.

- If you cannot claim the full tax credit amount, you may want to consider applying for the Additional Child Tax Credit. It’s important to note that the rules for this credit can be complex, but you don’t have to worry. The ATC Income Tax experts are always available to guide you through the process.

- Claim the dependent care credit if you’re paying for childcare to help you work. This credit can help you reduce your tax burden by up to $1,050 for a single child and $2,100 for two or more. Don’t miss out on this valuable opportunity to save on your taxes.

- It’s important to keep accurate records of all your childcare expenses. This can help make the tax filing process stress-free and hassle-free. So, always remember to maintain detailed records of all your childcare expenses.

Step 3: Why Choose ATC Income Tax to Claim CTC?

ATC Income Tax stands out as your trustworthy tax partner for several reasons:

- ATC Income Tax has a team of certified experts with vast experience of over 20 years in the tax industry. Our team works tirelessly to provide tailored guidance to meet your unique tax needs. We understand that taxes can be a challenging task, so we are here to assist in all things tax-related, including advance tax refunds and child tax credits.

- Our team has over 50 years of cumulative tax knowledge, which ensures that your tax-related concerns are addressed with expertise. We take pride in providing personalized services that cater to your needs, ensuring you get the most out of your tax returns.

- We know that the Child Tax Credit is essential to your tax return. That’s why we ensure that your Child Tax Credit is in safe hands, maximizing your tax credits while applying for tax returns.

Step 4: How to Use the CTCulator

Visit ATC Income Tax’s website, locate the CTCulator, or click here. Once you do that and scroll down to the CTCulator, you will be asked some questions that you must answer accurately:

- How many qualifying children under 17 are you claiming on your tax return?

- Did the qualifying child or children live with you for over six months during the tax year?

- What was your Adjusted Gross Income (AGI) for the tax year?

Step 5: Qualifying Child Rules & Assumptions

Understanding the rules for qualifying children before proceeding with advance tax refunds is important. Firstly, the earned income threshold for the refundable credit has been decreased to $2,500. Secondly, the beginning credit phase-out for the child tax credit has increased in 2018 to $200,000 ($400,000 for joint filers).

Additionally, the qualifying child must not provide more than half of their support to qualify for the credit. It is important to ensure you can claim the qualifying child as a dependent on your tax return, meeting all four tests. Lastly, please note that the CTCulator does not consider any exclusion of income from Puerto Rico and Foreign Earned Income.

Step 6: Qualifying Child Test – Must Meet All 6 Tests Below

Moreover, to qualify for CTC, you must ensure that your child meets all six tests:

- Age Test

- Citizenship Test

- Dependent Test

- Relationship Test

- Resident Test (with exceptions for temporary absences)

- Support Test

How to Use Education Credits Calculator or Educator

Education Tax Credits and Deductions can be very helpful for eligible students to get financial relief during tax season. ATC Income Tax has a user-friendly Edculator, which can help you determine the education credits or deductions for which you qualify. In this guide section, we will walk you through the steps of using the Educator, allowing you to check the advance tax refund you qualify for.

Step 1: Understanding Education Credits

You may be eligible for education credits or deductions on your tax return as a student. The Internal Revenue Service (IRS) provides several options to help you save money on your taxes.

These options include tax credits and tax deductions. Tax credits are a dollar-for-dollar reduction in the amount of tax you are liable to pay, whereas tax deductions decrease the threshold of your income subject to tax. Here are the options available to you:

- Tax Credits

- American Opportunity Tax Credit (AOC): This credit is available to undergraduate students working to get a degree. It is a refundable credit, which means that you may be able to receive a refund even if you owe no taxes.

- Lifetime Learning Credit (LLC): This non-refundable credit is available to undergraduate and graduate students. It can be used to offset the costs of tuition, fees, and other educational expenses.

- Tax Deductions

-

- If you are enrolled in an eligible institution and have submitted tuition or any other fees, you may be able to deduct these expenses from your taxable income. This deduction is available to both undergraduate and graduate students.

- If you paid interest on a student loan during the tax year, you may be able to take out upto to $2,500 from your taxable income. This deduction is available to undergraduate and graduate students who have taken out student loans.

Step 2: Choosing the Right Education Credit

It’s important to clearly understand the two main education credits before using the Edculator. The first one is the American Opportunity Tax Credit (AOTC), a refundable credit designed for undergraduate students. This credit is fully refundable even if zero tax is due and can be availed for up to four years.

The other one is the Lifetime Learning Credit (LLC), a non-refundable credit applicable to undergraduate and graduate students. Unlike the AOTC, the LLC applies to all years of higher education and is available for part-time students and those acquiring job skills.

Step 3: Accessing the Educator

Now that you understand the basics and have some knowledge, let’s proceed to using Edculator. First of all, you have to answer an initial question. Based on your answer, you’ll see other relevant questions. The first question is: “Who is the student?” You will see two options to answer this: Me or My Dependent.

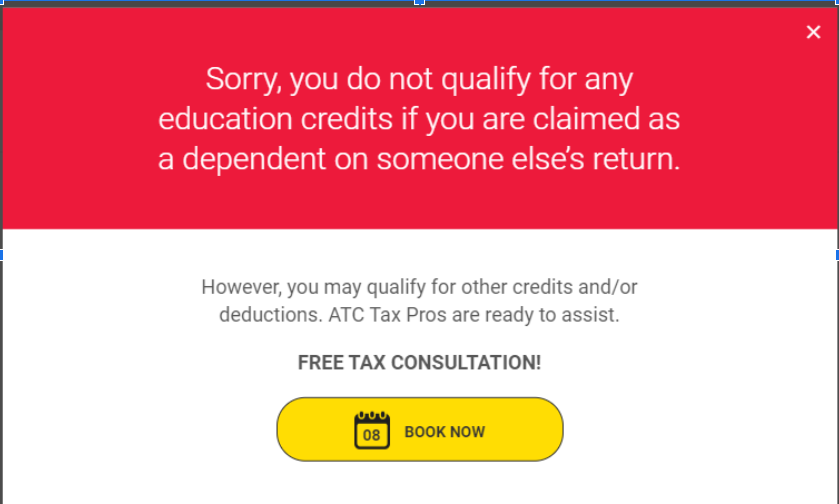

Step 4: Student Dependency Information

If, in the initial question, you have selected “Me,” then you’ll have to answer the following questions:

Question: Can someone claim you as a dependent on their return?

Options: Yes or No.

If you select No, then see step 5. If you select yes, then you’ll see the following message on your screen:

If, in the initial question, you have selected “My Dependent,” then you’ll have to answer the following questions:

Options: Are you claiming the dependent on your tax return?

Options: Yes or No.

If you select Yes, then see step 5. If you select No, then you’ll see the following message on your screen:

Step 5: Detailed Edculator Questions

- Answer all questions based on your previous selections:

If you have selected “Me” and then No:

- Is the student a degree or other credential candidate?

- Is the student enrolled at least half-time during the academic period?

- Is the student taking a course to acquire or improve job skills?

- Has the student completed the first four years of undergraduate college credits?

- Has the student used the American Opportunity Credit 4 times in prior years?

If you have selected “My Dependent” and then Yes:

- Is the student a degree or other credential candidate?

- Is the student enrolled at least half-time during the academic period?

- Is the student taking a course to acquire or improve job skills?

- Has the student completed the first four years of undergraduate college credits?

- Has the student used the American Opportunity Credit 4 times in prior years?

Step 6: Additional Rules and Considerations

It’s important to remember that certain rules and regulations apply to education credits and deductions. To be eligible for these benefits, you must meet specific criteria and adhere to various restrictions.

For instance, if you are filing your taxes separately as Married Filing, it is important to note that you are not eligible for any tax credits. Additionally, if you have a felony drug conviction, it may impact your eligibility for the American Opportunity Credit.

It’s worth noting that qualified education expenses include more than just tuition fees; they also encompass supplies, educational learning materials, and tools that are required for your studies. However, it’s crucial to remember that you can’t pay the expenses of your education with income or funds that are tax-free.

Keeping these rules in mind can ensure you receive the full benefits you are entitled to and avoid any potential issues or complications.

Step 7: Review and Qualify

After completing the questionnaire and responding accurately, you will learn about education credits or deductions for which you qualify.

Conclusion for Tax Calculator

Conclusion for Tax Calculator

By following the steps mentioned above, calculate advance tax refunds that you can claim. However, it is vital to note that the calculator is only based on generalized assumptions and covers the basics. If you want more detailed calculations or consultations for filing personal or business taxes, book a free consultation with our experts today.